DeFi lending platforms have become popular among crypto investors looking to earn yield on their tokens or access liquidity without traditional banks. For both seasoned crypto enthusiasts and newcomers, understanding the leading companies in this space is crucial for making informed decisions.

As highlighted in industry explainers like Forbes’ DeFi breakdown, decentralized lending is reshaping how users borrow and lend value across ecosystems.

Read on to discover a list of the best DeFi lending companies, highlighting their innovations, security, and features.

Quick Take

- DeFi lending is a rapidly growing sector offering a more transparent and efficient way to borrow and lend compared to traditional finance.

- When selecting a DeFi lending platform, it's essential to consider key factors such as security, liquidity, supported assets, and interest rate models.

- Liquidium, Compound, Aave, Curve, and MakerDAO’s Sky are leading DeFi lending platforms, each with its unique strengths and features.

What to Look For in a DeFi Lending Platform?

When assessing a DeFi lending platform, it is important to focus on the features that determine whether it is safe, efficient, and worthwhile to use.

Protocols should undergo repeated audits, bug bounties, and transparency reviews, an issue regularly studied in DeFi research such as this ScienceDirect analysis.

A smooth and intuitive user experience is essential, with clear navigation and simple processes for lending, borrowing, and managing positions.

Security is equally critical: platforms should undergo thorough, repeated smart contract audits by trusted firms, have a proven record of protecting funds, or provide insurance mechanisms to cover risks.

Another factor is the breadth of supported assets and chains. Leading platforms enable borrowing and lending with a wide range of tokens across multiple blockchains, helping users avoid being locked into a single ecosystem.

It is also crucial to understand how interest rates are structured, whether fixed, variable, or algorithmic, since this directly impacts the returns for lenders and the costs for borrowers.

Finally, in such a competitive technological space, innovation matters. Platforms that stand out often do so through unique tokenomics, gas-efficient systems, or exclusive access to certain assets.

Liquidium

Liquidium is a pioneering decentralized cross-chain lending protocol, launched to connect isolated blockchains without the need for centralized bridges. It allows users to supply native assets on one chain and borrow on another.

The platform uses a pooled lending model where users deposit funds into shared pools for each asset type. Borrowers can then take out overcollateralized loans using their cross-chain assets. The borrowed assets accrue interest, which is distributed back to the lenders.

Liquidium uses a dynamic interest rate model that adjusts based on the supply and demand within each asset pool, ensuring fair and market-driven rates.

Key Features of Liquidium

- Supported assets & chains: Liquidium supports Bitcoin, Ethereum, and Solana (incl. stablecoins on the latter two networks) with plans for further multi-chain expansion.

- Interest rate mechanism: A dynamic interest rate model that responds to market conditions, optimizing returns for lenders and managing borrowing costs effectively.

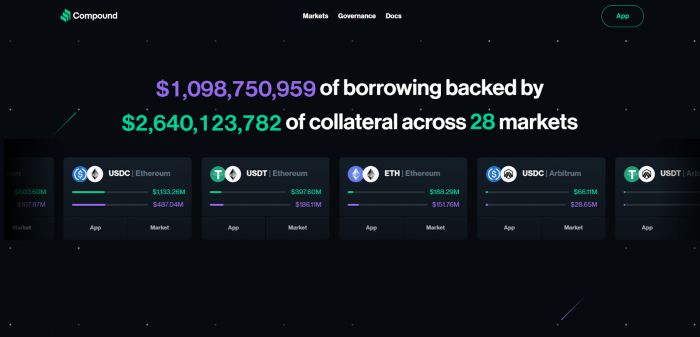

Compound Finance

Compound Finance is an EVM-compatible DeFi lending protocol that uses algorithmic money markets for lending and borrowing.

It operates as a series of cTokens, where users deposit assets to mint corresponding cTokens (cETH, cDAI). These cTokens continuously accrue interest. Borrowers, on the other hand, supply collateral and can borrow other assets from the pools, with interest rates determined algorithmically based on the utilization of assets.

Interest rates are algorithmically adjusted based on the supply and demand for each asset, creating efficient money markets.

Key Features of Compound Finance

- Supported assets & chains: Supports major ERC-20s on Ethereum and selected EVM L2s such as Arbitrum, Base, Polygon, and Optimism.

- Interest rate mechanism: Interest is algorithmically determined based on the supply and demand for each asset, ensuring rates adjust dynamically in response to market conditions.

Aave

Aave is a non-custodial platform for supplying, borrowing, and more across multiple blockchain networks.

The platform enables users to deposit assets into liquidity pools, from which borrowers can take out loans. Suppliers deposit assets into pools to earn interest, while borrowers provide overcollateralized loans.

Aave also introduced flash loans, which allow for uncollateralized loans that must be repaid within the same blockchain transaction.

Key Features of Aave

- Supported assets & chains: An extensive list of cryptocurrencies and stablecoins, including ETH, DAI, USDC, USDT, WBTC, and various other ERC-20 tokens.

- Interest rate mechanism: Variable and stable rates, with average stablecoin APY/APR tracked transparently.

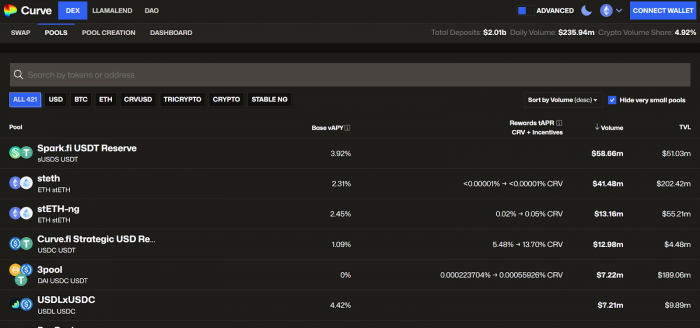

Curve Finance

Curve Finance is a stablecoin-optimized AMM, where lending occurs via liquidity provision to pools generating fee-based yields.

Users deposit stablecoins or LSTs into pools for low-slippage swaps and earnings, integrating with lending ecosystems for efficient and low-risk exposure.

While it doesn't offer direct, collateralized lending, Curve Finance’s stablecoin liquidity pools are crucial for the broader DeFi lending landscape. Lenders can deposit stablecoins into Curve pools to earn trading fees and CRV rewards, which can then be further utilized in other protocols to generate lending yield.

Key Features of Curve Finance

Supported assets & chains: Primarily supports stablecoins (DAI, USDC, USDT, BUSD, etc.), but also wrapped versions of other assets like wBTC and stETH,

Interest rate mechanism: For its swap pools, rates are effectively determined by trading volume and pool utilization. For lending integration, the underlying lending protocol dictates the rates.

Sky (formerly MakerDAO)

Sky, formerly known as MakerDAO, is a decentralized protocol that powers the DAI stablecoin through collateralized debt positions (CDPs).

Users interact with the Maker Protocol by opening a "Vault." In this Vault, they deposit approved collateral assets (like ETH, WBTC, etc.). Based on the value of their collateral, users can then generate (borrow) DAI.

The loan is subject to a variable interest rate known as the "Stability Fee." Users can repay the DAI and the accrued Stability Fee at any time to reclaim their collateral.

Key Features of MakerDAO

- Supported assets & chains: Supports a vast and growing array of collateral, including ETH, wBTC, real-world assets (RWAs), and LP tokens from other major DeFi protocols.

- Interest rate mechanism: The Stability Fee is a variable rate determined by MKR token holders through governance votes, which maintains DAI's peg to the US dollar.

Which DeFi Lending Platform Should You Choose?

Choosing the right DeFi lending platform hinges on your specific needs, risk tolerance, and asset preferences.

For Bitcoin holders seeking native yields without selling, cross-chain innovators like Liquidium offer unparalleled flexibility and convenience. If you're focused on Ethereum ecosystems, established protocols such as Aave or Compound provide mature, audited environments for diversified borrowing.

Ultimately, non-custodial platforms with strong cross-chain compatibility stand out for their ability to unlock liquidity across silos, reducing reliance on single networks and enhancing overall security. This approach aligns with DeFi's core ethos of control and interoperability, making such platforms ideal for users prioritizing long-term efficiency.

As decentralized liquidity grows, cross-chain, non-custodial protocols are gaining the most traction, mirroring user behavior across Web3 platforms. Even creators exploring new digital systems, like those experimenting with generative tools such as Riffusion AI or fantasy simulators like Joyland AI, increasingly choose DeFi lenders that offer more control and interoperability.

DeFi’s core strengths, ownership, automation, and composability, mean that platforms combining these principles are poised to lead the next wave of financial innovation.

Conclusion: The Future of DeFi Lending Belongs to Cross-Chain, Non-Custodial Protocols

The DeFi lending landscape is more competitive, and more innovative, than ever. Platforms like Liquidium, Aave, Compound, Curve, and Sky (MakerDAO) continue to push decentralized finance forward through stronger security, broader asset support, and increasingly efficient interest models.

While each platform has its strengths, a clear pattern is emerging:

users prefer non-custodial, cross-chain solutions that offer flexibility without sacrificing safety. Liquidium leads this evolution by enabling native, trustless, multi-chain lending, while blue-chip protocols such as Aave and Compound remain pillars of the Ethereum ecosystem.

Post Comment

Be the first to post comment!